Mark’s £300K Dilemma: UK Property vs Dubai – Where Would You Invest?

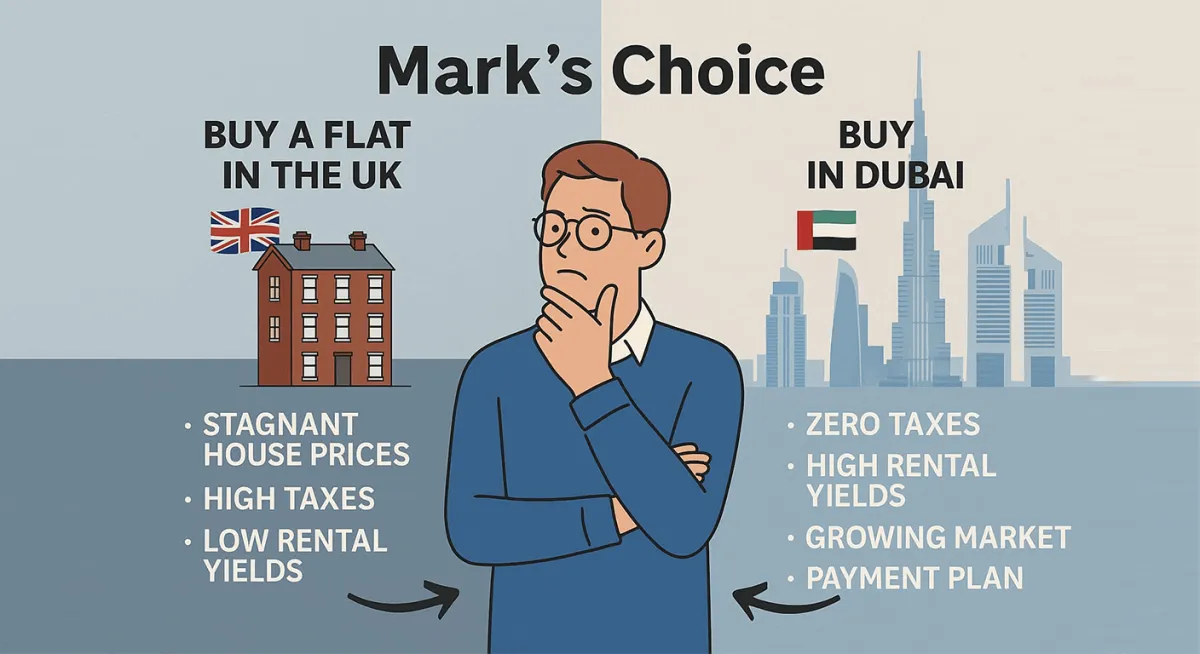

Meet Mark, a 42-year-old British professional sitting on £300,000 in savings. After years of watching his UK pension fund crawl and the housing market stagnate, he decides it’s time to invest in real estate.

He has two choices:

Buy a flat in the UK – familiar, but slow returns and high taxes

Explore Dubai – newer market, but growing, tax-free, and globally in demand

Here’s what happens when Mark dives deeper.

Option 1: Buying Property in the UK

Property Price: £300,000

Stamp Duty + Legal Fees: ~£10,000

Rental Yield: ~3.5% = £10,500/year

Tax on Rental Income (20–40%): ~£2,000–£4,000/year

Council Tax + Maintenance: ~£2,000/year

Mortgage? Yes, but with high UK interest rates (now over 5%)

After 5 Years:

Gross earnings: ~£52,500

Net after tax and expenses: ~£35,000–£38,000

Capital Gains Tax & 40% Inheritance Tax apply

House price growth in UK (2023–2024): just -1.3% (Nationwide)

Net outcome: Low yield, high tax, limited growth.

Option 2: Investing in Dubai Real Estate

Mark considers Dubai—and he’s surprised by the flexibility.

20% Down Payment = ~£60,000

NO mortgage needed upfront

Monthly plan: Pay the rest 30–50% over 2–5 years

Post-handover: Flip it, rent it, or take a mortgage

Rental Yield: 8–10% = ~£24,000/year on full value

No Stamp Duty, No Income Tax, No Property Tax

Property price growth in Dubai (2023): 19% average (CBRE)

2024 forecast: 9–12% growth (Knight Frank)

After 5 Years:

£120,000 earned tax-free

Potential resale gain of 20–30%

No inheritance or capital gains tax

Mortgage can be activated later to release cash

Mark realises: Dubai is not just property—it's a strategy.

What Convinced Mark?

UK real estate has stalled

Dubai offers flexibility, zero taxes, and rental demand

He only needs to deploy 20% now and can build the asset gradually

Future exit options: resale, mortgage, or high-yield rental

Brighton to Burj – Built by Someone Like Mark

Mark didn’t know the Dubai market. Until he found Brighton to Burj, a boutique real estate advisory founded by Amit, a British national who lived in the UK for 15+ years.

Amit understood the real pain points:

Inheritance tax

Stamp duty

Market fatigue

Mortgage stress

Legal confusion overseas

Brighton to Burj offers end-to-end guidance tailored for UK-based investors.